How To Return A Product To Asus For Repair Or Replacement

Do you lot know how to correctly ready your shipment paperwork to avoid customs duties and taxes when, and where possible when making a repair and replace or warranty replacement shipment?

Take you lot or your customers e'er been surprised past an unexpected neb for customs duties and taxes? Defoliation sets in. You thought the shipments were items in need of repair or scale, or maybe they were warranty items, or but being returned because they were the incorrect parts. Hundreds of companies around the globe are faced with this dilemma each day.

What may be surprising to hear is that nigh of these situations are preventable. All information technology takes is the cognition to correctly set your shipment'due south paperwork.

In this article, nosotros discuss the key mistakes leading to this issue, and explain how you can correct these mistakes with the proper knowledge.

It's important to state here, that it is a common misconception that all shipments involving returns are always duty and taxation complimentary. They are not.

To begin, lets deconstructing the essential elements. Nosotros need to separate the shipments in to two types: those that are exported out of the U.Southward., and those that are imported into the U.S. It's of import to do this in lodge to bring attending to the starting time error many companies make — the paperwork (which includes the air waybill, and commercial or Performa invoice) are being completed in the same way regardless of the reasons the shipment exist. This beliefs is at the root of the problem. Export and Import shipment paperwork are not the aforementioned!

To fix shipment paperwork correctly i must always accept into consideration the 5 Central ELEMENTS that Customs officials use to decide if they will permit a shipment to enter their country, and at what rates of duty and revenue enhancement.

What are the FIVE Fundamental ELEMENTS?

1. REASON FOR IMPORT / INTENDED USE — this is often 1 of the well-nigh overlooked considerations, and it can have a huge touch on the outcome. The more the customs officials can ascertain from your paperwork the better.

2. ACCURATE DESCRIPTION OF THE Commodity — an authentic description is very important. Stay away from full general terms when describing your article. Function numbers don't hateful anything to Customs agents; the space they accept upwards is amend served with an authentic description.

3. VALUE OF THE Article — More oft than non, there is confusion almost the value of the commodity. Many shippers gravitate toward either end of the spectrum. On i end, "it'southward a return, and so the value is nothing, isn't it?" While on the opposite finish, "Nosotros paid $10 amount when we bought the thing, and then I guess that's the value?" Both of these extremes are wrong for this type of shipment.

four. HTS Lawmaking USED — which HTS code you use is incredibly of import! For many shippers, they're not concerned much about the HTS codes unless they too had to file an EEI with AES. The proper HTS lawmaking should exist provided by the shipper on all shipments. It'south extremely important for the type of shipment we're discussing.

The HTS code, put but, is an internationally accustomed organisation of numbers that friction match up to a specific article description, then that customs officials around the world can know what the commodity is regardless of the language spoken. The HTS lawmaking for shipments exported from the U.S. is as well referred to as the Schedule "B" number.

Various countries around the world may add variations to the HTS codes from time to time, just only for their specific country. The U.S. is no exception. Currently all U.S. Imports are cleared using a special addition to the HTS codes chosen the H.T.Southward.U.S. (Harmonized Tariff Schedule of the United States).

Again, we illustrate that export and import shipment paperwork cannot exist prepared the exact same manner. If the shipment will exist Exported from the U.Southward. then the shipper should use the proper HTS lawmaking, besides known equally the Schedule "B" number.

In the case of an Import coming to the U.S., the shipper is to use the right H.T.Due south.U.S. lawmaking, which is used by U.S. Customs to clear all imports.

v. COUNTRY OF ORIGIN — Final, but not least, is knowing the Country of Origin, as well known equally the COUNTRY OF Manufacture. Information technology is used by customs officials to determine where the commodity was made.

Why is this important? Around the world, at that place are many trading alliances between countries. These trading alliances are also called things like Merchandise Agreements (such as USMCA), or Preferences (such as the GSP or "Full general Organization of Preferences") . Some of you may have also heard of alliances such as MFN (Nigh Favored Nations), or Developing Countries.

Under the authority of trade agreements, participating countries have agreed to brand sure concessions on duty and taxes levied on commodities made in other participating countries. This is also true for the shipment type we are discussing. The concessions made by community under the trade agreements will vary widely; ranging from duty-costless to lower rates of duty.

Now that you accept been given more insight into what makes customs officials tick, you know to ALWAYS consider the FIVE Fundamental ELEMENTS. Lets bring information technology all together with some practical examples.

In these examples you'll observe helpful directions, and as e'er nosotros're here to aid.

Example 1 – Consign Commercial Invoice

Example 2 – Export DHL Air waybill

Example 3 – Import Commercial Invoice

Instance iv – Import DHL Air waybill

Examples

In these examples, please presume that y'all are the manufacturer and y'all are located in the US.

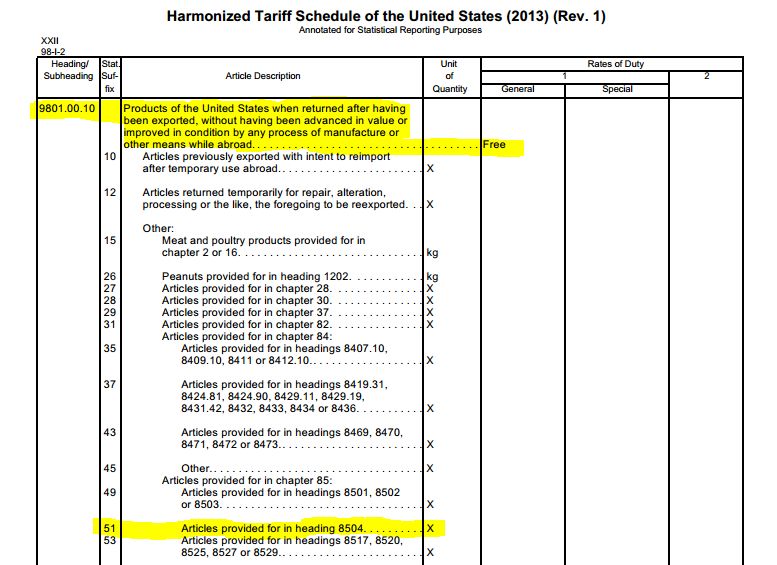

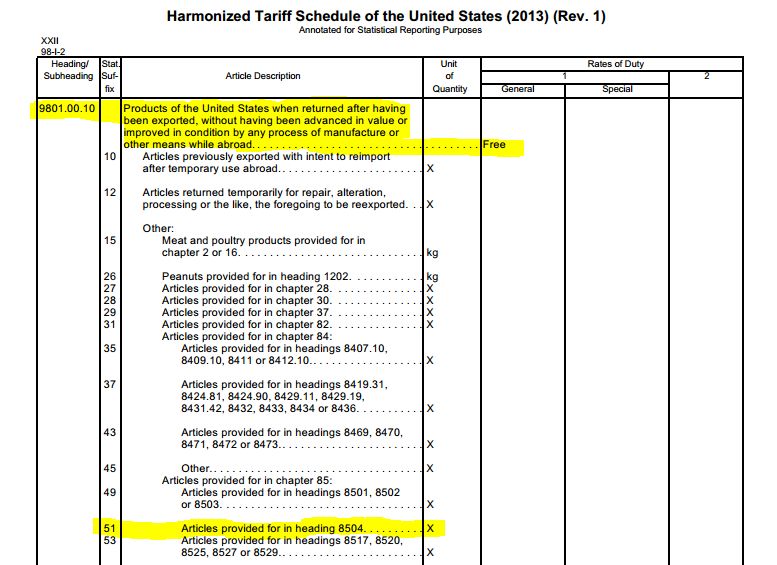

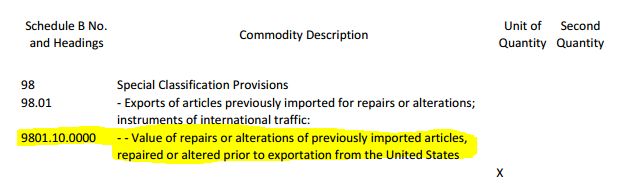

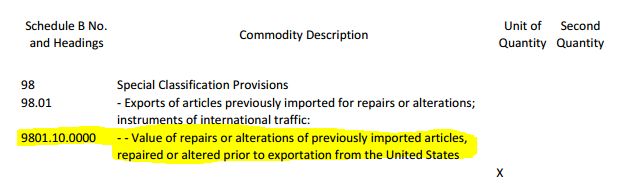

International Customer returning item to you for repair/replacement

Let'due south say the shipper in Federal republic of germany is your client and is returning an detail for repair or replacement. Y'all are the United states of america manufacturer. The Commercial Invoice and Air waybill should use the HTS Code of 9801.00.10XX. The "XX" volition depend on the actual HTS Code of the detail being returned. The screenshot below is an example of the HTSUS Code. Visit the HTSUS and use the advisable suffix in chapter 98. The invoice should state the detail existence returned and state that it is returning for repair (for case: power supply lath; returning for repair). The value should be listed every bit what it would cost to replace the item if it were lost. Ever marker these kinds of shipments equally DAP, significant the receiver pays any duties or taxes. If yous select DDP, some countries will non articulate the shipment as a repair/return or something inbound the country temporarily or returning to the country.

Now let u.s. say y'all are done with the repair and you are returning the item back to your customer in Federal republic of germany. The HTS Code used for items returning to the customer should exist the correct HTS or Schedule B number for exports. In the description of the product, country that the shipment is a repaired item returning to the buyer (for example: power supply lath; repaired item returning to buyer). The value should be the cost of the repair, or if opting for shipment insurance the value should exist the replacement cost of the product (non a sale price) and the price of the repair.

You are returning an particular to an international manufacturer for repair.

In this state of affairs, you are returning an detail to the manufacturer in some other country for repair/render. Dissimilar the US, most other countries don't have a special HTS Code for products of the U.s. repairs/returns. And so, mark the waybill with the bodily HTS Code of the production using the HTS or Schedule B number for exports and country the particular is returning for repair/replacement (for example: ability supply board; returning to manufacturer for repair). The value should be what it would toll to supervene upon the item if information technology were lost. Indicate on the commercial invoice that the reason for export is temporary.

When the manufacturer is ready to render it to you, they need to employ the HTS Lawmaking appropriate for the product being returned. The Invoice should state the item being returned and state that it is returning for repair (for example: power supply board; returning for repair). The value should be the price of the repair. If opting for shipment insurance the value should be the replacement cost (not the sale price) and the cost of the repair. Always mark these kinds of shipments equally DAP, meaning the receiver pays whatsoever duties or taxes. If you select DDP, some countries will not clear the shipment every bit a repair/return or something entering the land temporarily or returning back to the country.

Nigh the Examples

Another discussion regarding the HTS codes (A.Thousand.A. Schedule "B"), and the HTSUS codes. You understand how of import it is to have the correct HTS or HTSUS lawmaking, but did you know that at that place is a special HTS/HTSUS code specifically structured to cover returns when the product is of the United states of america? Using this code where appropriate on the shipment's paperwork volition further ensure that the correct level of duty and tax are assessed on your shipment. Visit the HTSUS.

U.S. Import — In this snip, permit's say that the shipper in Deutschland is your customer, and is returning the PLC power supply board for repair or replacement. Yous are the U.South. manufacturer. Y'all would have your client in Germany apply this H.T.S.U.S. code. This code is a special code specifically meant for returns. This will help ensure duty-complimentary clearance.

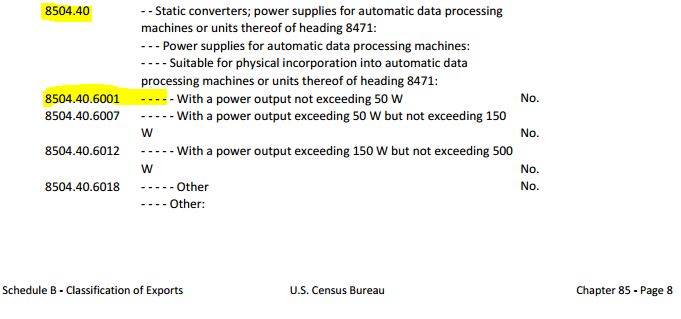

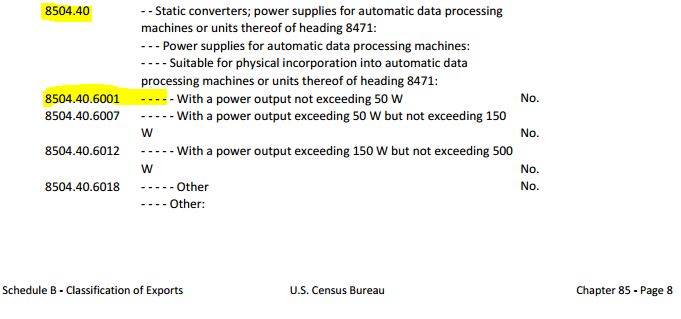

U.South. Export — In this snip you're looking at the HTS codes (A.One thousand.A. Schedule "B"). As in our export case, you're returning the PLC ability supply board back to the manufacturer in Germany. You would utilise this HTS code to ensure that community understands the commodity.

U.S. Export — This snip contains a special HTS code meant for returns that you tin use if you are the U.Southward. manufacturer, and yous're returning the PLC power supply lath, afterward repairing or replacing it, back to your customer in Federal republic of germany. This will help ensure the right amount of duty is accessed at clearance.

Source: https://preferredship.com/kc/repair-replacement-warranty-returns/

Posted by: booneanstly.blogspot.com

0 Response to "How To Return A Product To Asus For Repair Or Replacement"

Post a Comment